Buying a second home is something many people dream about. Whether you are looking to get a holiday home, a property to rent or just want to own multiple properties as a long-term investment (like 40.9% of British homeowners with a second home). It goes without saying that if you can afford to buy a second house, there aren’t many disadvantages of increasing your property portfolio! Plus, you already have the experience of purchasing a first home, so you already know how to buy a second home- you are probably familiar with the process!

Here are some things to consider when buying a second property

How to get a mortgage on second house purchase

Firstly, for those wondering if you can get a mortgage on a second property whilst still repaying your first mortgage- the answer is yes, you can! This additional mortgage is called a “second mortgage”, and you can apply for this whether you are going to rent out a second home, or live in it. In order to get approved for a second home mortgage, you will usually need:

- A large deposit– more than the amount you put down on your first property (usually at least 25%).

- A good credit score – if you have missed previous mortgage payments, it may be hard to get approved for a second home mortgage.

- An income that is high enough to make repayments on both mortgages – equally, you will need the finances in place to pay the higher interest rates on second home mortgages.

- A statement as to whether you plan to rent out the second property or live in it -the mortgage provider is likely to take into consideration your rental income.

In order to get a mortgage on a second home, it may be worth waiting a while in order to pay off more of your first mortgage. The lower your monthly repayments, the more likely you are to secure a second home mortgage.

How much is stamp duty when buying a second home?

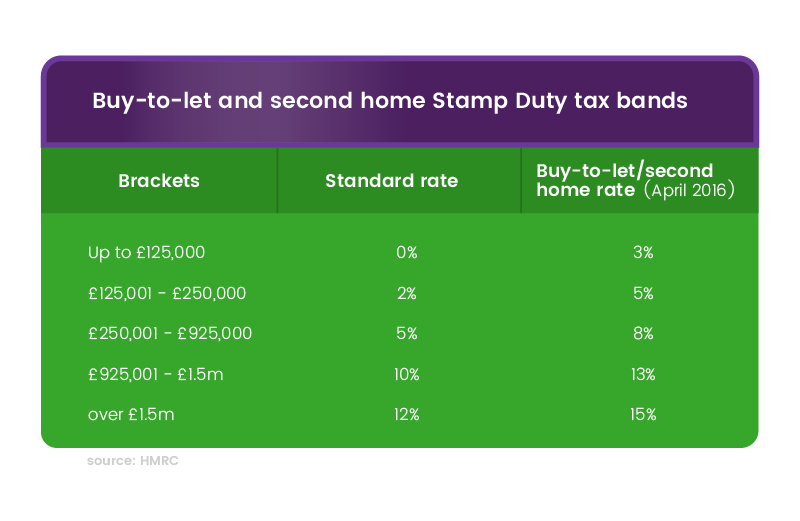

So, you have been approved for a mortgage, but what is the stamp duty on a second home? Well, the second-home rate is usually a little higher than your standard rate for each price bracket. This has been the case since April 2016, when it was announced that 3% would be added to the standard rate for stamp duty in each band. It is the same case for buy-to-let stamp duty too. HMRC has stated the rates to be as follows for each property price bracket:

Up to £125,000 3%

£125,001 – £250,000 5%

£250,001 – £925,000 8%

£925,001 – £1.5m 13%

Above £1.5m 15%

The extra stamp duty to be paid on a second home can be off-putting, so you may be wondering if there are any ways to avoid stamp duty on second home. Put simply, it is very hard to get out of paying stamp duty – pretty much impossible, in fact. However, if you sell your original first property within 3 years, there is the possibility of getting the extra stamp duty paid back. Another point to bear in mind is that you are still liable to pay the extra stamp duty if your second property is abroad.

How does buying a second property affect taxes?

Other than the extra stamp duty land tax, you’ll also want to know about the other tax implications of buying a second home. You will mainly be affected by Capital Gains Tax (or CGT). This is a type of tax which is payable on your possessions worth over six thousand pounds (excluding your car). It is a tax that only affects your second property and isn’t payable on your main residence. When the time comes to sell your second residence, any increase in value will be taxed, as opposed to the whole amount being taxed.

Can you avoid capital gains tax on second home?

The only way to avoid capital gains tax on a second property is if it will become your main residence. If this is the case, to avoid paying CGT when you wish to sell the property later, you will need to get in touch with HMRC

Tips on how to save money for a second house.

Now you know the process of buying a second home, but how do you get there in the first place? We’ve put together a few pointers on how to save up for a second investment property.

1. Know what you can afford

Depending on what needs you have for this property, whether it’s a holiday home or a rental investment, it can be even more costly than the first property you’ve bought. You also need to take into account that things like homeowner insurance and property taxes will be higher for your second home. Take some time to look at your earnings and the debt obligations you have and that you will have buying a second property. This can help you get an idea of what you can afford and pay mortgage for.

2. Make a savings plan

If you’ve decided you are looking to buy a second property it’s time to start thinking about how to finance a second home. If you are struggling to put some money aside, one way to do so is by making a list of your monthly outgoings. Separate the list into two, necessary spending and unnecessary spending. In the first list you put things such as bills, taxes, petrol money and food. In the unnecessary list you put things such as a gym membership, subscriptions and other disposable spending. At the end have a look at the things that are vital to you and the things you could get rid of. After making the saving plan, you’ll need to try to stick to it at all costs.

3. Avoid making an impulse purchase

You have your budget sorted, but you like a house that you can’t afford: try not to make any an impulse purchase you might later regret. While the seller is probably looking to sell the house quickly, but for a good price. Therefore they won’t drop their price significantly, even if you put in an offer. Think carefully about whether you will be able afford to pay the mortgage for your second house, or whether it will be financially draining. Try to be patient and keep looking for properties within your budget, you are sure to find one that you love and can afford.

4. Continue saving even after you have made the purchase

A big mistake people make after purchasing a second home is they go a bit wild with their finances after paying for the deposit as they feel the hardest part is over. However, you need to keep in mind that it’s very easy to go off track with your money, and once you get past a certain point, it’s hard to recover. So, our advice is to continue avoiding unnecessary spending, so you always know you can afford to pay the mortgage and other expenses that come with your second house.

Feature image credit: DniproDD / Shutterstock.com