A foreword from the Prime Minister, Theresa May:

“Our broken housing market is one of the greatest barriers to progress in Britain today. Today the average house costs almost eight times average earnings – a record. Thus, it is difficult to get on the housing ladder, and the proportion of people living in the private rented sector has doubled since 2000.

These high housing costs hurt ordinary working class people the most. In total, more than 2.2 million working households with below average incomes spend a third or more of their disposable income on housing.”

So, it seems we (those of us aged 25 – 34 anyway) are in a slight ‘situation’ when it comes to buying a home in 2017. Home ownership in this age group has fallen from 59% just over a decade ago – to 37% today and the Council of Mortgage Lenders predicts that by 2020 only 25% of 30-year-olds will own their own home. Certainly, with only 11% of land in England built on, perhaps the best explanation for such dismal statistics is a strong case of supply and demand.

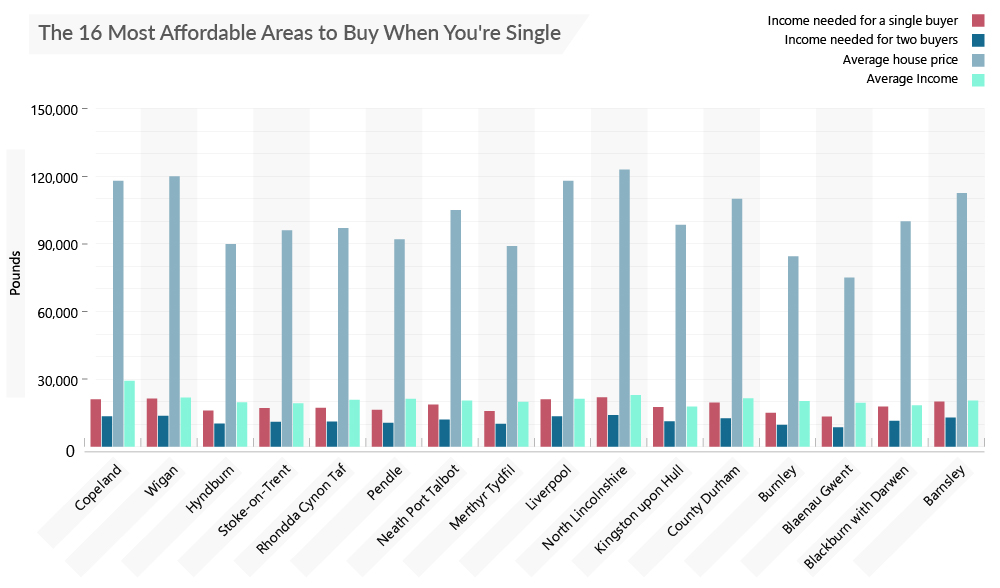

To add even more smoke to an ever-encroaching flame, if you happen to be single and southern – well then, you may as well quit while you’re ahead. Since, not only does supply and demand dictate that there simply isn’t enough of what we need, or where we need it, but new research by Savills has identified only 16 out of 348 council districts across England and Wales offer a SINGLE BUYER (on an average income) the ability to purchase independently – and none are in the South of England.

Evidently, it is fast becoming impossible for many to purchase where they live – but none more so than those situated in the South.

Unsurprisingly, the report by Savills found single buyers to be priced out of Greater London, the East and the South East completely, where property prices are continuing to spiral out of control. In fact, recent figures from gov.co.uk reflect the average house price in Greater London (£483,803), the East (£281,513) and the South East (£316,026) as far greater than the North West (£152,259), Yorkshire and The Humber (£154,985), the West Midlands (£181,328) and Wales (£148,177.) Proving great disparity between regions.

Photo credit: Nadin3D/Shutterstock

Per analysis of ONS data, the cost of an entry level home across England and Wales has increased by almost 20% in the last decade at £140,000 and for new properties – up to £180,000. Though the recent Government Housing White Paper for England outlines ways in which first-time buyers will be supported in saving, such as through the ‘Lifetime Savings Account’, which offers a 25% bonus on top of savings towards the purchase of a first home. However, if this is the case, prospective buyers will be looking at approximately £300 in stamp duty, £2,000 in legal and moving costs and savings of at least £21,000 for a 15% deposit – totalling £23,300 all in. An amount that will likely mean that for many, achieving the savings needed will remain a distant dream.

Yes, it seems the only way to afford a house as an individual in the South (and even then, only just) is to a) find a partner first or b) rely on the support of Mum and Dad, a willing guarantor or find yourself in an extremely fortunate and profitable position. All options which are not – and will not – be viable possibilities for millions of people across the UK. Of course, there is the option to rent but that often ends up costing a lot more than just cash. Such high demand and low supply offers plenty of opportunity for exploitation, unreasonable letting agents’ fees, unfair terms in lease and the rise of corrupt landlords who continue to let their already dangerously over-crowded properties to desperate renters.

Photo credit: SpeedKingz/Shutterstock

Worryingly, vulnerable tenants are being pushed further from the housing market as cuts to benefits and rising costs mean rents are increasingly out of touch with not only income but reality. The Royal Institution of Chartered Surveyors (‘Rics’) has stated that those on low incomes will face further difficulties as members predict a rise of more than 20% in rent over the next five years. A situation hindered further by the fact that landlords are becoming increasingly reluctant to rent to those who receive any benefits at all.

Aside from these issues, there’s the fact that couples renting can barely make ends meet – let alone a single person. Renting permits seeing most of the monthly wage flushed away before there’s time to acknowledge it, leaving little (if any) excess to put into deposit-starved saving accounts. Comparably, the average couple in the private rental sector now send half their salary to their landlord each month. So, where exactly does that leave an individual renting via their own means, particularly in the South? Without question, it appears housing options available to first-time buyers remain favoured toward those coupled up and/or settled in the North.

Sellhousefast.uk decided to ask a range of 25 – 34-year-olds about their current, individual property prospects and below are just a handful of the accounts received:

Photo credit: Family Business/Shutterstock

Emily, 24, single, St. Albans

“I’m fortunate that my parents decided to gift me £20,000 for a deposit. If I didn’t have it? Well, I wouldn’t see home ownership in my future. My parents made the decision to pass on my inheritance early because they know how difficult the property market is now. They want me to make the most use of their money at the point that will make the most difference to my life and in 2017 that happens to be securing a home to make my own. I won’t buy in St. Albans though; I’ll look to move up North where I can get so much more for my money.”

Craig, 31, single, Essex

“I’ve been working full-time in London for the past decade, whilst paying above and beyond to rent a tiny flat in Essex, due to crippling rental prices in the capital. It has taken me the best part of 10 years to save up a suitable deposit for an average buy and I’m in the throes of securing my first property now. It’s nowhere near to where I work though – I’ve had to look on the outskirts to find a place I can afford by myself. Most of my friends with partners managed it years ago.”

Alice, 25, in a relationship, Birmingham

“Up until recently I was living in Bury St. Edmunds, where I’m originally from, but I decided to move to Birmingham to live with my boyfriend as places to rent are so much more affordable and as we split all costs, it’s compatible with my basic, graduate starter salary. It’s been worthwhile in terms of living arrangements, but I miss being close to my family and friends.”

James, 27, in a relationship, Great Yarmouth

“I’m still living with my parents in the same house I grew up in. It’s hard because I long for the opportunity to establish my own home with my long-term partner, but we just can’t afford to make the move yet. I think about moving somewhere more affordable most days, near to where I studied for my degree (Lincolnshire), but it would all depend on finding a job role that could take me there.”

Lauren, 25, single, Sheffield

“I’ve been working steadily as a social worker since graduating from University in 2013 and last year, I managed to purchase my first home. I feel fortunate that I live where I do – especially when I consider the fact that, so far, I am the only person from my friendship group to be able to purchase. Most of my friends live in the South and it’s near enough impossible for them. My house is only small, but it’s a start and I’m so happy.”

In speaking with these individuals, Sell House Fast identified a clear pattern of struggle and frustration – but also one of determination. Yes, the younger generation based in the South seem to be the most affected by the property crisis, but they don’t appear to be resting on their laurels; they are considering options and taking advantage of the opportunities that are available to them – such as moving further afield. Yet undeniably, the report by Savills and the research conducted by SHF does highlight an unfair advantage, which may not be levelled out anytime soon.