What is Inheritance tax?

Inheritance tax (IHT) was introduced in 1769 to tax the wealthy elite, where wealth was simply transferred down from one generation to the next rather than to sell house fast. The money collected from this tax would be redistributed throughout the population. Poorer people would not be required to pay inheritance tax.

The housing market, however has changed dramatically in those 200 years and it is no longer exclusively the very wealthy being taxed leaving more feeling the brunt of high IHT especially with the rise in property prices sky rocketing. Leading to the government making changes to the highly controversial tax

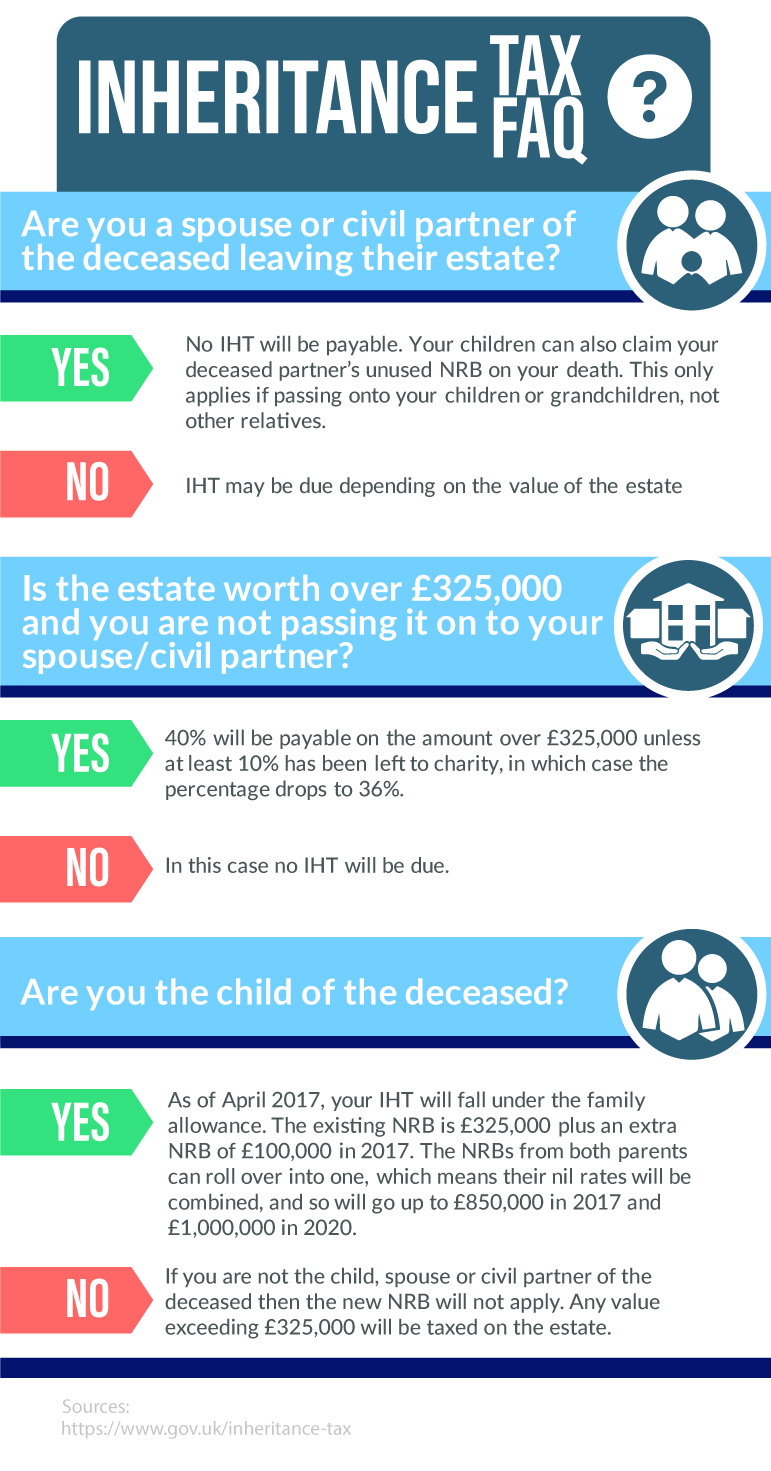

Inheritance tax (IHT) is a tax paid after someone’s death if the total sum of his or her estate (including property) is worth over £325,000 (the current rate). The tax is on the estate of the deceased and is paid before the beneficiaries receive anything. It is paid at the rate of 40% of everything over £325,000.

So here is your guide to inheriting a home and how to comply with inheritance tax!

So…

If the total of the estate is worth £800,000:

£800,000 minus the nil rate band (NRB) of £325,000 = £475,000

40% of £475,000 is £190,000, which is the IHT owed on the estate

But, there is no IHT to pay for people who die and leave everything to their spouse or civil partner.

So, what’s changing?

A new NRB of £100,000 will be added onto the existing NRB of £325,000. This will gradually increase until it is frozen in 2020 at £175,000.

This means on top of the £325,000 the extra £100,000 gives a new rate of £425,000.

This doubles to £850,000 when both husband and wife/civil partner are deceased and the unused NRB rolls over from one spouse to another.

However, these new rules only apply to families leaving their entire estate to their children.

Is it always 40%?

No, it goes down to 36% if you leave at least 10% of your estate to charity. So with an estate worth £425,000 there would be an IHT payable of £32,400 instead of £40,000.

If all of your estate is left to charity, no IHT will be paid

How can IHT be reduced?

Reducing IHT is complicated but it is possible by:

- Putting your assets into a trust – trusts are complicated though so it’s wise to seek financial advice on this.

- Making yearly gifts of up to £3000 in total, plus extra gifts for children and grandchildren

- Leaving money to charity

- Paying into a pension instead of a savings account

Inheritance tax case studies:

Example 1:

Andy is 65. He has no children and plans to leave his property to his brother Ben, with some assets going to his niece and nephew. He keeps regular checks on how much his estate is worth and works out that it is approximately £600,000. He is a long-term supporter of Cancer Research and decides he wants to leave 10% of his estate to them, which he states clearly in his will. This would mean that the current total liability drops from 40% to 36% resulting in a reduction in the IHT to pay.

He makes sure he has an up to date will that has been drawn up by a solicitor and which states exactly what each beneficiary will inherit. He starts with what is easiest to value such as savings and valuable objects, then property, stocks or share investments, pensions and finally objects of sentimental value.

He ensures he is careful with his money and does not incur any debts, as these will be deducted from his assets when he dies to pay the creditors.

He makes some tax free gifts each year to his niece and nephew. He also gives his nephew a gift of £1000 when he gets married which is also considered a tax-free gift.

Example 2:

Dan and Lisa’s grandmother died 5 years ago and recently their grandfather also passed away. Their parents Mike and Fiona contact the family solicitor to sort out the will. The nil-rate band rolls over from both grandparents meaning the new IHT threshold amount is £850,000. The total assets are valued at £900,000, leaving £50,000 liable for IHT at 40%, which is £20,000 owed. The will sets out that will Mike and Fiona inherit the property, valuables and some investments, but a £50,000 sum is to be put into a trust for Dan and Lisa, which they will receive when they reach 18.

Their grandparents made a number of gifts throughout their lives, but those made less than 7 years prior to their deaths may have to count towards the estate, so could still be included as assets for IHT purposes.

Once the funeral costs were paid for, the executor of the estate – a family friend who works as a solicitor – has to administer the assets and distribute the gifts to the beneficiaries as stated in the will. He is also appointed as the trustee of the trust set up for Dan and Lisa.

Photo credit: Lisa S./Shutterstock

Despite the controversy surrounding inheritance tax, it doesn’t appear to be going away anytime soon. We hope this brief guide has given you the basic low-down on the changes in inheritance tax commencing in 2017. If you are seeking to reduce your inheritance tax amount or are confused about your will, it is best to see a financial specialist or solicitor as rules can be complicated. For more in-depth information regarding inheritance, see the governmental website:

https://www.gov.uk/inheritance-tax/overview.

Feature image credit: William Potter/Shutterstock