Christmas is a time for celebration but it is also a time to take extra precautionary measures. According to the NHS, as many as 80,000 people need to be hospitalised each year due to injuries directly related to winter festivities, while the risk of death in a house fire increases by 50% during the holiday season. The merriest day in the year has been shown to be particularly prone to fire accidents – these are reported to increase by more than 100%.

20% of British Homes Believed to be Inadequately Insured

It’s unknown how many British homes are inadequately insured or uninsured altogether. According to the Association of British Insurers (ABI), up to 20% or one fifth of UK households may be without sufficient insurance, with the majority not even realising that they don’t have enough cover. Cover for damage caused by fire is a standard of most home insurance policies, however, this doesn’t necessarily mean the damage will be covered in full. This is because the insurance company is not obliged to pay for the damage to the building or its contents above the sum insured.

Considering all the gifts and presents that tend to accumulate during the holiday season, the percentage of British homes without adequate insurance during Christmas probably exceeds 20%. Many insurance companies automatically increase contents insurance during the holiday season with an aim to cover the extra value due to Christmas gifts. However, not all insurance policies automatically increase the contents cover. Also, increased contents cover is valid only during the holiday season – that’s normally 30 days before and after Christmas. But most importantly, homes without enough cover are still underinsured even if their insurance company increased the limit of cover.

Does Your Home Insurance Cover Fire Damage Caused by Christmas ‘Hazards’?

Even if you are fully insured, your claim for fire damage can sometimes be rejected. Since Christmas is just around the corner, we asked the nation’s leading home insurers whether they cover for fire damage caused by faulty fairy lights, candle accidents, overloaded plug points and other Christmas ‘hazards’ and in which situations the fire damage claim can be rejected.

Image Credit: Ronnarong Thanuthattaphong/Shutterstock

All insurers asked told us that the standard home insurance policies cover fire in all the above mentioned situations including fires caused by faulty fairy lights, candles and overloaded plug sockets, explaining the insurance claim in these cases would be rejected only in the event of fraud, severe negligence and withholding key information from the insurer – for example, sub-letting your property. All, however, also emphasised that the policyholder is expected to take ‘reasonable care’ to prevent damage, loss, injury or liability. Caroline Hunter from the Co-op Insurance added that they only refuse claims in “exceptional circumstances” but if for example, “we discover that faulty lights, or other electrical equipment is at fault we may opt to pursue a recovery from the manufacturer for our outlay for damage caused due to faulty equipment.”

Fire Not the Only Threat of Damage to Your Property during Winter Festivities

Winter festivities are not only associated with the increased risk of house fire. Ian Crowder, a spokesperson from the AA told us that “thefts from homes is also an issue at Christmas and we see a spike of burglaries at this time of year.” Similarly, the big-name insurers report an increase of accidental damage claims, mostly involving celebration-related accidents such wine stains and cigarette burns ruining sofas and carpets, valuable glassware getting broken, paintings being knocked off the wall, etc.

Image Credit: Charles Haire/Shutterstock

Contents insurance typically covers your valuables against damage such as fire and flooding as well as theft. In contrast, accidental damage usually isn’t included in the standard home insurance policies. So if you would like to be covered for this kind of damage this Christmas, contact your insurance company and enquire about the options.

Stay Safe and Prevent Property Damage during the Merriest Time of the Year

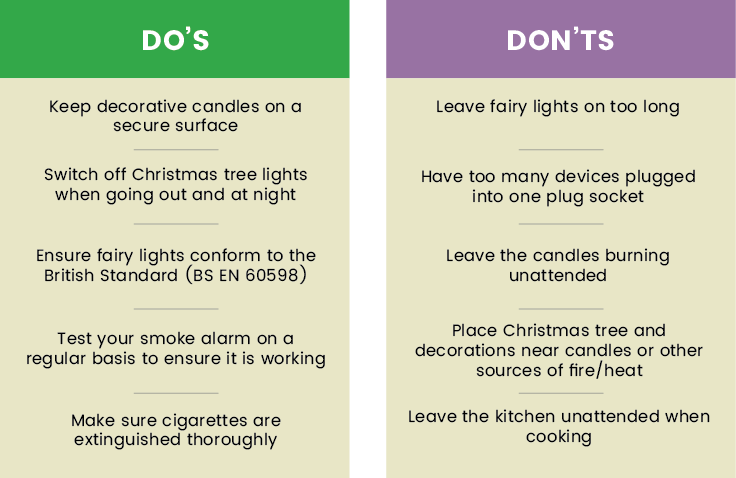

In addition to making sure that your home insurance policy provides cover in the event the worst happens, you are also highly recommended to take the precautionary measures bellow to stay safe and reduce the risk of property damage during the merriest time of the year.

Feature Image Credit: MarynaG/Shutterstock