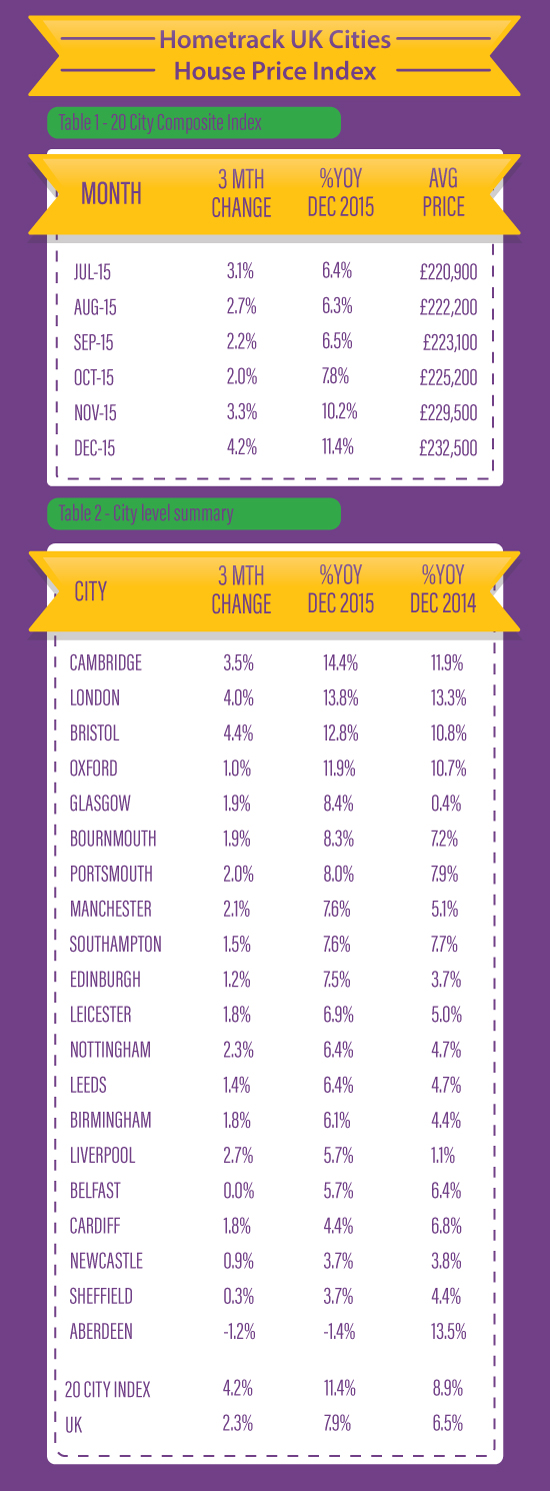

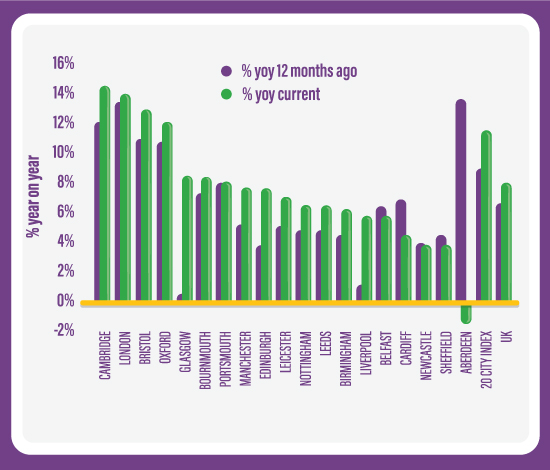

It’s no surprise anymore when you hear about house price inflation. Though figures remain unsurprising to many, what is more disconcerting is how much the annual rate of house price growth is shifting. In a report released by Hometrack UK Cities House Price Index, it was recorded that house price inflation is running at 11.4 per cent, up from 10.2% the previous month. Compare this to twelve months ago and the rate of house price inflation was 8.9%.

City level house price accelerated to 15 month high as housing demand continually increases. Home owners are becoming just as important as overseas and home investors and the cities that are leading unusually high property price growth are Cambridge and London. However, despite generating a growth, both cities had low sales volumes in 2015. HM Revenue and Customs conducted a data report which showed a 10% increase in sales volumes in the last three months of 2015.

Hometrack UK Cities House Price Index

Strangely, Cambridge’s housing market is performing its highest annual rate of growth (14.4%), compared to London which has seen a growth of 13.8%; slightly lower than expected for England’s capital city. Both cities are suffering due to a scarcity of homes available as well as the availability of affordable housing for first time buyers in particular and those seeking to upgrade. The pressure to buy is reflected in new housing schemes such as the Help to Buy ISA and the Help to Buy Equity Loan.

Cheaper areas such as Glasgow and Liverpool had a significantly positive increase in house price growth. Both cities are in the process of undergoing a housing market recovery over the past 2-3 years. Glasgow last year had a price inflation at 0.1% but has risen to 8.5%. Similarly, Liverpool had a house price growth of up to 5.7% from 1.3% in 2015.

Hometrack UK Cities House Price Index